Mortgage Servicing Rights Valuation Model

Our model is an improvement over previous MSR pricing models by explicitly incorporating the realistic assumptions that there are additional costs involved in servicing delinquent loans. The most accurate customizable mortgage servicing rights MSR valuation model now on a convenient cloud-based software platform.

What Is A Mortgage Servicing Right Msr

It is critical for financial institutions to report the fair value of their MSR holdings.

Mortgage servicing rights valuation model. Mortgage Servicing Rights Portfolio Valuations For those clients who do not desire the sophistication of our MSRlive. Features like portfolio valuation custom. Mortgage Servicing Rights Software MSRlive.

Actual Cash Flow Analysis. Precise analysis and opinion of value Summary tables of major portfolio characteristics. Fair values should be based upon market prices and market-based valuation assumptions.

Assessing Mortgage Servicing Rights Using a Reduced-Form Model. The valuation and hedging of mortgage servicing rights. This study constructs a valuation model from which an option-adjusted spread approach is employed to value individual mortgage servicing contracts for both adjustable rate and fixed rate mortgages.

At the most rudimentary level MSRs are the capitalized value of the right to receive future cash flows from the servicing of mortgage loans. Mortgage-pricing tree we extend additional sub-branches to model the borrowers decision of prepayment cure and foreclosure after a loan becomes delinquent. Fee revenue schedules are stable gains and losses on the valuation of mortgage servicing rights are difficult to manage particularly in volatile market conditions and the current interest rate environment keeps interest income low.

Changes in the valuation of mortgage servicing rights depend upon the growth in the mortgage portfolio along with any notable market swings. First it is important to define mortgage servicing rights often referred to by the acronym MSR. In addition to the Hilliard et al.

Our mortgage servicing rights software helps MSR Portfolio Managers and mortgage banking professionals more efficiently build optimize and manage their MSR portfolio. Valuation Models should be based on realistic estimates of adequate compensation future revenues prepayment speeds market servicing costs mortgage default rates and discount rates. The concept of capitalized value asserts that the current value of an asset can be determined based on the total income expected to be realized over its.

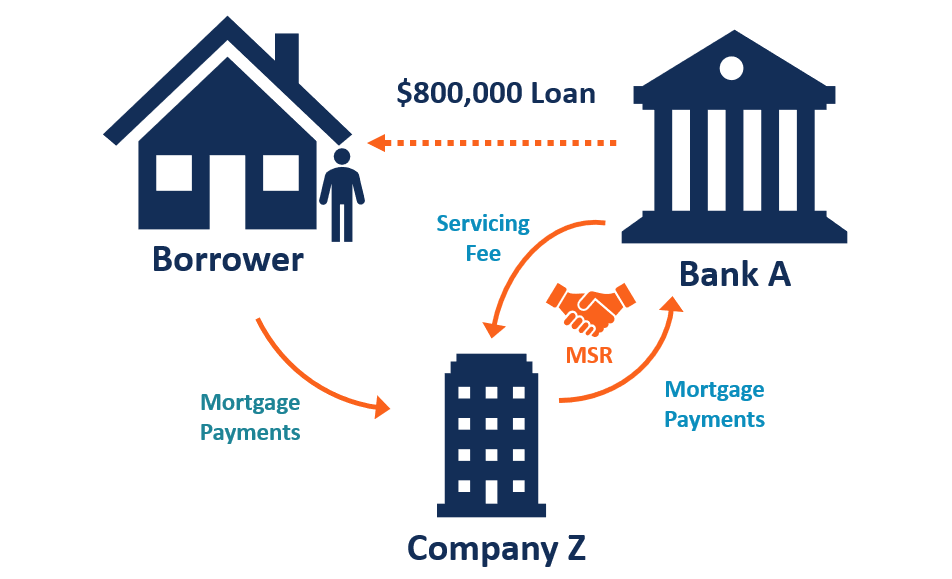

The Mortgage Servicing Rights Valuation MSR valuation process is an integral step in determining the overall financial success of a financial institutions mortgage operations. Mortgage servicing rights are sold by the originator of a mortgage to another financial institution which then takes over the administration of the mortgage which includes such tasks as. The servicing fee the net cost to service.

Mortgage Servicing Rights MSR Pricing Software WinOAS is the industry-leading residential commercial and reverse mortgage servicing rights valuation model. Our model is an improvement over previous MSR pricing models by explicitly incorporating the realistic assumptions. By offering a very personalized mortgage servicing rights valuation service McQueen Financial will help your financial institution meet regulatory requirements as well as make informed financial decisions.

Mortgage servicing assets Verified 7 days ago mortgage servicing rights gaap. Used for calculating loan-level cash flows and generating asset values WinOAS is the most widely used and validated MSR model in the industry. Mortgage Servicing Rights September 2015 Given the number of assumptions used in valuation models considerable judgment is required to estimate the fair value of MSRs and changes in these assumptions could materially affect the estimated fair value of the servicing rights.

Servicing model software but still need to determine the value of their MSR asset MCT can provide timely portfolio valuation reports. The Effects of Interest Rate Risks Prepayment and Default Risks and Random State Variables Abstract Accurately assessing the value of a mortgage servicing rights MSRs is an important task for market participants. Institutions should ensure that financial models used throughout the company for mortgage servicing including valuation hedging and pricing be compared and that differences between the values obtained be identified supported and reconciled.

The cost of servicing did decline for many participants in recent periods primarily because delinquency rates have fallen to less than half of peak rates3. We develop a bivariate binomial model to price Mortgage Servicing Rights MSRs. All Software Solutions Include.

Mortgage servicing rights 101. Base Cost to Service 21299 25250 3951 DeliquencyForeclosure Costs 537 757 220 Total Cost to Service 21836 26007 4171 Net Income 224043 200673 23370 Phoenix model includes late fee income in ancillary income One Month Modeled vs. CHARACTERISTICS OF MORTGAGE SERVICING Mortgage servicing rights grant the owner the right to receive certain cash flows and encumber the owner with the responsibility to pay certain other cash flows.

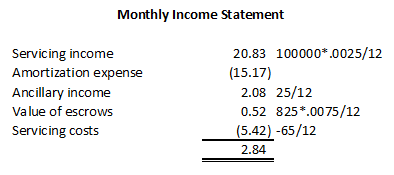

We develop a bivariate binomial model to price Mortgage Servicing Rights MSRs. A very simple model divides the servicing cash flows into six sep-arate components. The agencies encourage institutions to obtain periodic third-party valuations by qualified market professionals to support the fair values of their mortgage servicing rights and to update internal models.

Fluctuations in prepayment speeds and the weighted average discount rate along with movements in the weighted average life of the portfolio lead to differences month-over-month. We then investigate how the value.

Pdf Valuation Of Mortgage Servicing Rights With Foreclosure Delay And Forbearance Allowed

Frb Evolution Of The Mortgage Servicing Market Since 1998 Report To The Congress On The Effect Of Capital Rules On Mortgage Servicing Assets June 2016

White Paper Accounting Regulatory Reporting For Mortgage Servicing Rights

Frb Evolution Of The Mortgage Servicing Market Since 1998 Report To The Congress On The Effect Of Capital Rules On Mortgage Servicing Assets June 2016

Pdf Valuation Of Mortgage Servicing Rights With Foreclosure Delay And Forbearance Allowed

What Is A Mortgage Servicing Right Msr

Pdf Valuation Of Mortgage Servicing Rights With Foreclosure Delay And Forbearance Allowed

Frb Evolution Of The Mortgage Servicing Market Since 1998 Report To The Congress On The Effect Of Capital Rules On Mortgage Servicing Assets June 2016

Frb Risks To Firms Holding Mortgage Servicing Assets Report To The Congress On The Effect Of Capital Rules On Mortgage Servicing Assets June 2016

What Is A Mortgage Servicing Right Msr

What Is A Mortgage Servicing Right Msr

Mortgage Servicing Rights Msr Overview Example Importance

What Is A Mortgage Servicing Right Msr

Pdf Valuation Of Mortgage Servicing Rights With Foreclosure Delay And Forbearance Allowed

Frb Evolution Of The Mortgage Servicing Market Since 1998 Report To The Congress On The Effect Of Capital Rules On Mortgage Servicing Assets June 2016

Frb Evolution Of The Mortgage Servicing Market Since 1998 Report To The Congress On The Effect Of Capital Rules On Mortgage Servicing Assets June 2016

Post a Comment for "Mortgage Servicing Rights Valuation Model"